Can 2020 get any more strange? Strange puts it mildly. It has been a very challenging year from so many perspectives in life. We had COVID-19 ravage our state and nation, and we are not out of the woods by any means, the economy took a nosedive, the worst short-term drop in GDP on record. Then riots ensued due to social injustice. We are not even halfway through 2020. Michigan has, of course, been among the hardest struck states considering COVID-19’s health & economic impacts and then the protests.

While the violence is ongoing and our nation struggles, let’s take a step back and just review where we stand. Your situation is important. Perhaps you or a loved has lost employment or you live near where scary protests and police brutality are taking place. “This too shall pass” has meant different things as the year has progressed, but life has a way of returning back to normal over time.

Many pundits are calling for massive changes to domestic and corporate life following all of this. While some of those predictions may come to be, a lot of it won’t. Sure the work-from-home movement will probably pick up steam, but we also recognize the need for human interaction perhaps now more than ever. So the office environment will slowly return, and we may experience fewer Zoom meetings. There has been some solace in the effects of the stay-at-home movement – we do get to enjoy more time with our loved ones and spend less time on the road for business travel. Of course for individuals without a family, this can be a very lonely time – please check in with them if you know somebody living on their own.

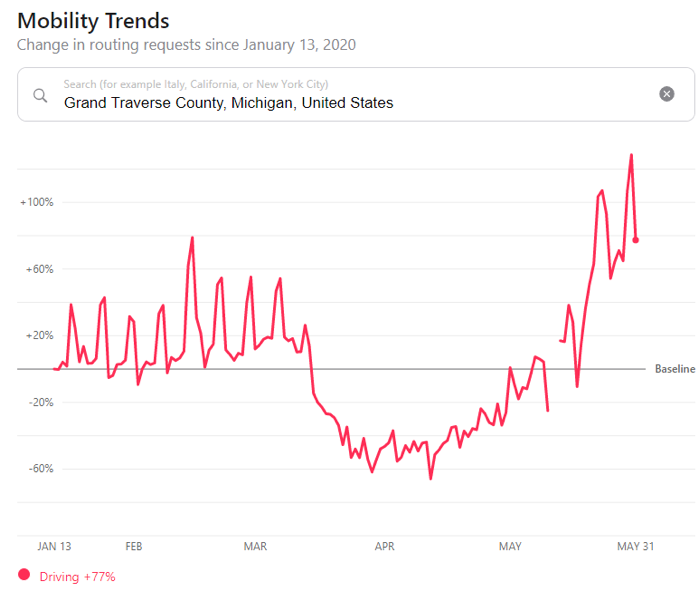

While the economy and state of Michigan was at a stand-still just a few weeks ago, we are recovering. People are moving around more and the COVID-19 positive test rate across the nation is falling. Life is slowly returning to normal here in Michigan. Folks are out and about more according to Apple Mobility Trend data.

And did you know there were comparable pandemics in 1918 and 1957? Not many people recall those events. Unfortunately many Americans were afflicted and even died from flu outbreaks back then. Over time, not overnight, life resumed to normal. The world even got better since then. Today we have a higher standard of living, people live longer, and the economy is by almost all measures more prosperous.

Nevertheless, the stock market has been such a contrast to the current economy and way of life this year. Believe or not, that is often the case. The stock market, for better or worse, does not care about racism or how people feel. Stocks are ‘forward-looking’ – meaning they look beyond what has taken place and focus on the future of business. Despite COVID-19’s major economic impacts and uneasiness surrounding the social situation right now, stocks are telling us things may just in fact get better.

Could stocks fall back and volatility return? Absolutely that is possible – nobody knows what will take place, but in some respects it has been comforting to see our accounts bounce back from those scary times in March. The bottom line on that point is that investors must stick to their long-term strategy and not get panicked in the moment of high volatility and discouraging headlines.

It’s also important to avoid getting sucked-in to checking your account balances each day, week or even month. The investment piece of your financial plan is meant to perform over the long haul. It’s going to ebb as the market ebbs, but our portfolio strategies own bits & pieces of capitalism that have a tried & true history of providing solid long-term performance.

There are so many financial & political issues that individual investors have little to no control over. I.e. how the economy does, how the S&P 500 performs, what inflation is doing, who will win the White House in that election in five short months .. the list goes on.

Here’s the point: It’s better to focus on what you and I can control – our long-term financial plan. Are you contributing to your 401(k) to the match? Are you funding your HSA? Have you thought about locking in record low mortgage rates? Do you have an estate plan? When was the last time you updated your will? What life events have taken place that could have altered your insurance needs? These are items you have control and responsibility over. Let’s work together to ensure you are still on track.

Featured Image: Photo by Markus Winkler on Unsplash