It has been a tumultuous couple of months locally and worldwide. Naturally, there have been many questions, so I thought I’d summarize some of the more common themes in Q&A format.

As always, if you have any questions, or just need to talk, we are available.

Q: What are your feelings about the economy/markets during the pandemic?

A: I’ve seen or studied many things that could upset clients and markets. There is not much literature to compare to this. While I am optimistic, I am aware that this event-driven turmoil is different and more painful for society than anything I’ve seen or studied. This disruption is the collision of financial health with physical/psychological health. The market will recover, but it could look a bit different when the immediate concerns subside.

Q: How do you see this crisis playing out?

A: The two extremes are as follows: On the optimistic side, everything opens up by the end of June, unemployed come back to work, and the economy returns to normal by year-end. The fiscal stimulus and low-interest rates serve as fuel to the economy for years to come. On the pessimistic side, unemployment approaches 20%, normalization is delayed for a year or two, and there is huge demand shock in multiple sectors. The effects of lockdown on business and oil price crash create a depression-like scenario. While I have no actual idea of what will happen, my magic 8 ball leads me to believe it will be somewhere in the middle where we slowly reopen sectors by exposure risk, unemployment percentage approaches double digits, economic activity craters until mid-summer, but pent up demand starts and economic rebound in late q3-q4 with normalization middle of 2021. If a treatment protocol is developed, this could be accelerated.

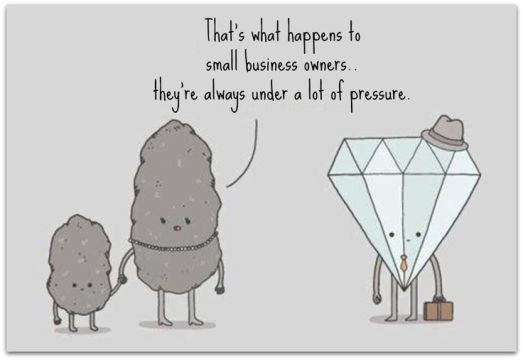

Q: How are local businesses faring during this crisis?

A: We are seeing medical clients furloughing employees and cutting compensation. Restaurant, entertainment, and hospitality clients are getting crushed. Accounting and Insurance clientele seem to be in decent shape. We are having numerous discussions with these clients regarding whether to terminate, furlough, and/or reduce compensation as well as evaluate all programs available. While approaches are all over the map, we are seeing a trend of lowering compensation for a period of time, subject to reevaluation regularly. Businesses are trying their best to keep employees employed.

We are encouraging clients (business and personal) to negotiate with all creditors on an as-needed basis, but well before it becomes critical. Whether that be suppliers, insurers, vendors, landlords, or banks, any and all relief is on the table. We think communication helps to manage the expectations of all parties. Anyone who has started these conversations is encouraged to consult before signing so all details are available details are known.

Q: What is TFC doing to coordinate coronavirus troubleshooting with other trusted advisors?

A: We have been identifying clients who may be eligible for benefits and/or relief programs and bringing them up to speed on the specifics of the programs. We coordinate these discussions with their CPA and Attorney. TFC brings the general knowledge of the programs, logistics, and understanding of the client. The CPA interprets the specifics of tax relief programs. And the attorney provides counsel relating to creditors and signatory documents. It is very much a team effort.

Q: 26 million people are unemployed and the economy is at a standstill…why aren’t stocks down more?

A: 3 things: 1)fed liquidity, 2)treasury fiscal stimulus, and 3)the S&P 500 is a cap-weighted index and is not necessarily representative of the broader economy. The fed has provided an unlimited backstop to keep money flowing. If this were to cease before the economy begins moving again, we could see something much different. The treasury has issued trillions in grants, loans, and downright helicopter money to try and ease the pain felt by businesses and individuals alike. If you’re looking at the S&P and shaking your head, I’m right there with you. But, the market as a whole, is working. The pain being experienced by retailers, hotels, casinos, energy, and homebuilders is being offset by larger size companies in technology, healthcare, biotech, utilities, and consumer staple supply chains, hence the disconnect in S&P movement.

Q: Is there anything I should look out for?

A: Protecting against coronavirus-related cyber attacks. Fake calls to wire money to charity. Fake emails to check your stimulus payment. Fake, fake, fake. Hackers have time on their hands, and people are more vulnerable under stress. Be vigilant and consult with us if you are unsure.

Q: Should I be changing my investment strategy?

A: Unless you are short on cash then, generally, no. Most clients went into this with high concentrations of cash/treasuries. The investment discipline you’ve heard me talk about for years is playing out. The gains we took in years past and deposited to cash/treasuries has provided dry powder to take advantage of current and continuing dislocations without impacting the current standards of living.

Q: What brings you hope through this?

A: The markets and economy were strong before the pandemic, which suggests a relatively high likelihood for a good recovery, post-pandemic. However, I do believe some things will be permanently changed (and born) of this event. We’ve seen a forced acceptance of virtual everything (work, weddings, births, deaths, hiring, reorganization, schooling, training, etc). If you have not yet become familiar with virtual programs such as Zoom or GoToMeeting, we suggest you start to become proficient as these tools are invaluable, even in non-pandemic times. Supply chain management has also come into focus as truly “essential.” To date, our supply chain has been very solid (with the exception of TP and paper towels!). It will be interesting to see what, if any, of these changes will become permanent.

Above all, we’ve seen a growing number of people supporting each other. Most can cast their political views aside and recognize the stress almost everyone is under. The need for individual support is high, and our neighbors are stepping up for those in need

Best,

DPD

Derek,

A very well presented review and discussion. Keep up the good work.

Thank you Derek. Your calm in the midst of such confusion is comforting.

Thank you . You are always a great wealth of knowledge and comfort.

excellent q & a

Thank you