Archegos Affliction

Ever heard of Archegos? Neither did we before this hedge fund blew up late last month.

Archegos Capital Management is the now infamous investment group that had trades go the wrong way, leading to a fire sale of assets that pressured parts of the stock market at times in March. Still, the drama was just that – drama. The stock market ended the week at all-time highs. But the writers need something to get in a tizzy about!

Let’s take a step back. What are hedge funds and what is a family office?

Hedge funds are opaque investment companies that often take risky bets to achieve massive returns for their partners and investors. If the wagers work out, investors look like geniuses while the firm’s partners can make huge earnings as compensation. Hedge fund profits are taxed favorably, which catches the ire of politicians and populists. But that’s a story for another day. Let’s not get all riled up.

Archegos is actually technically not a hedge fund, but a family office. A family office is geared toward a more specific group of investors and provides a broader range of financial services than a hedge fund. In contrast, A hedge fund is focused on generating huge returns for its partners and investors.

What went bad

The liquidation of Archegos and its market ramifications can be unsettling. But don’t go jumping off a bridge – hedge fund and family office investment company blow-ups are normal. Investors at these types of firms inevitably get in over their skies and turn way too risky. Other institutional investors, often at major banks like Goldman Sachs and Morgan Stanley, sometimes have exposure to the funds. In this case, Goldman and Morgan said they avoided most of the risk. Well, that’s a relief. Good for them. Credit Suisse and Nomura had more extensive exposure.

No impact to you and me

But what about us? Of course, TreMonte does not invest with hedge funds. There’s no point, in our view. Fees are incredibly high, and there is a lack of transparency. Often, your money is tied up, so if you need to pay the bills or want to blow your cash on a hot new ride, you are out of luck – you must wait until the hedge fund lets you have your money back.

Hedge funds’ share of the market

Hedge fund investments also comprise a relatively narrow slice of the investment universe. According to Barclay Hedge[i], the total assets under management for hedge funds is $3.8 trillion. PWC reports that the total global AUM was about $111 trillion[ii]. So hedge funds’ share is puny at less than 4% of global assets under management. Yet the press loves to talk about them, don’t they?

Don’t worry – you and I are not missing out on much

Hedge fund performance is also nothing to write home about. According to the CFA Institute[iii], returns from 2004 to 2016 averaged just 0.6% per year on the HRFX Global Hedge Fund Index. Contrast that to a tidy yearly gain of 7.7% on the S&P 500 and 5.8% on foreign stocks. Even bonds crushed the “hedgies” – returning 4.2% in that timeframe. Isn’t it funny that a simple yet appropriately managed investment strategy beats the pants off the returns generated from the most sophisticated (supposedly) investors and traders on Wall Street??

Market dynamics

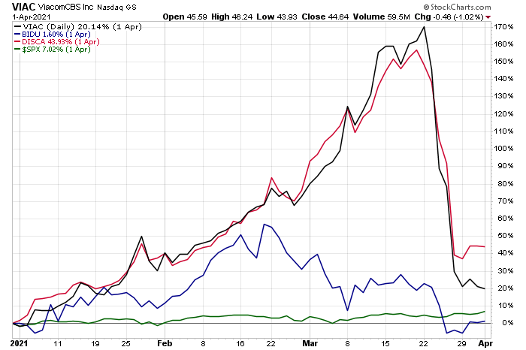

There are market impacts, though. The major holdings of Archegos had to be sold at whatever price necessary, so we saw significant losses for stocks like Viacom, Discovery, and several Chinese stocks at times last month. ViacomCBS and Discovery were hammered back on March 26 as shares of each fell about 50%. All the while, the S&P 500 didn’t budge much and ended last week above the 4,000 level for the first time.

Year-to-date chart: Shares of ViacomCBS, Discovery, and BIDU were slaughtered while the stock market ($SPX in green) was somewhat steady[iv]

So why did those shares fall so hard from just one family office having to sell? Archegos was using leverage and derivative products. They are complicated and opaque tools to make big bets. These products are ways to juice returns, but when the market goes against the holder, it can get ugly quickly! Warren Buffett calls options (a derivative instrument) “financial weapons of mass destruction.” Archegos Capital Management is a case in point. The Wall Street Journal reported that the firm’s owner, Bill Hwang, lost $8 billion in ten days[v]. That’s a rough stretch, I guess!

The OTC market – a land of danger!

Archegos built significant positions in these stocks in a risky way. I know we are getting the weeds here, but derivatives trade in the “over the counter” (OTC) market. That means for every buyer, there is a counterparty who has sold the product to the investor. That makes for counterparty risk. Often the big banks are the counterparties in these transactions, so their risk departments have to ensure their traders do not violate risk parameters. Unfortunately, many of the analysts in the Wall Street bank risk departments are fresh out of college and are not exactly experts, so properly assessing risk exposures at huge multi-national banks is an almost impossible task.

Have your eyes glazed over yet? Wall Street is a complex world!

Control the controllable and focus on your long-term plan

For us, simplicity wins out. Keeping things straightforward has value and allows us as financial advisors to focus on your situation and your financial plan.

Have a great week!

[i] https://www.barclayhedge.com/solutions/assets-under-management/hedge-fund-assets-under-management/

[ii] https://www.pwc.com/ng/en/press-room/global-assets-under-management-set-to-rise.html

[iii] https://blogs.cfainstitute.org/investor/2017/03/06/the-golden-age-of-hedge-funds/

[iv] http://stockcharts.com/h-perf/ui?s=VIAC&compare=BIDU,DISCA,$SPX&id=p64018189046

[v] https://www.wsj.com/articles/inside-archegoss-epic-meltdown-11617323530