Executive Summary

- Economic growth beginning to accelerate as stimulus checks get spent, and vaccines are administered

- With more jobs and higher wages comes inflationary pressures and rising prices

- Stock market returns were in the black for March, capping off a fantastic quarter

Starting to hum along

Economic growth is beginning to accelerate. We can see that trend in the monthly Federal Reserve regional financial reports released throughout the month. The latest batch from March shows some impressive figures. We thought nothing would be more exciting than kicking off this month’s update with some Federal Reserve data. Enjoy!

Figure 1: Regional Federal Reserve economic reports (Bespoke Investments)

The regional reports revealed a few things:

- GDP is set to rise very quickly. The US is on pace for its best year of economic growth since at least 1984. Recently, the US Federal Reserve increased its official 2021 GDP growth outlook to 6.5%, while Wall Street forecasters are even more bullish. Bank of America projects +7%, while Goldman Sachs sees +8%. Bear in mind the long-term average is in the 2-3% range (closer to 2% over the last 15 years). The regional economic surveys bolster the narrative of a recovering US economy, and the forecasts by the Fed and from the big banks suggest the same. The Philadelphia Fed regional report’s 51.8 level was the highest in nearly 50 years! In other news, the monthly ISM Manufacturing survey, among the most important economic data points, registered at 64.7 for March (any number of 50 indicates economic growth). March’s reading released on Thursday last week was the best figure since 1983, showing robust economic growth at the moment.

- Costs are on the increase. When the Fed regional surveys are released, traders immediately flip to the line-item mentioning prices paid. In general, the prices paid indexes suggest the cost of raw materials and their delivery are spiking. The NY Empire Manufacturing report showed the Highest Prices Paid reading (Figure 2) in a decade.[i]

- Demand for jobs. While costs going up sounds like a potentially harmful thing for you and me, an improving labor market should make for higher wages and more job opportunities. According to the latest Employment Situation report released on Good Friday, the recent stimulus helped the US economy add 916,000 jobs in March. Total nonfarm jobs are just 5.5% below their February 2020 peak. The unemployment rate stands at 6.0%.

Figure 2: Prices Paid Index in the NY Empire Manufacturing survey

Stimulus, spending & taxes

The economy continues to chug, bolstered by immense stimulus from Congress and an easy-money policy from the Fed. More spending is on the way as President Biden announced a $2 trillion infrastructure spending bill late last month[ii]. Higher taxes on corporations and the wealthy may be incoming to help pay for it all. We’ve discussed these topics in our new Weekly Happenings report (which I’m sure you have been reading thoroughly!)

Financial market summary

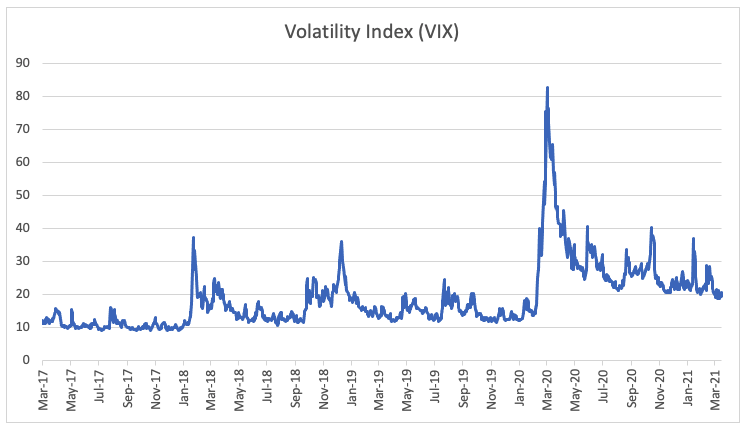

March was yet another strong month for stocks to cap off a great quarter. Volatility continues to run above average, considering how high the major stock market indexes are. Usually, volatility is low when stocks are high and high when stocks are low.

The “VIX” is the primary barometer for market volatility, and it has had a tough time breaking down through the 20% level (Figure 3). For perspective, the VIX was in the low 10s during the calm markets of 2017 and much of 2019. It then spiked to above 80% during the worst of the COVID crash. It also got above 80% at the depths of the Great Financial Crisis of 2008. The VIX settled at its lowest level in more than a year last week.

Figure 3: Chicago Board Options Exchange (CBOE) Volatility Index since March 2017

For the quarter, stock market investors were rewarded handsomely while bond investors took it on the chin. The S&P 500 rose 4.2% in March (+4.4% including dividends), while the Dow Jones Industrial Average had the biggest gain among the major indexes, +6.6%. Tech stocks were hot for much of last year, but they were the underperforming group last month, rising 1.8%. US small caps had a stellar quarter, and the group managed to squeak out another 0.9% gain in March as measured by the Russell 2000 index.

Figure 4: March 2021 US stock market returns

Looking ahead, the US stock market tends to perform well during the second quarter, particularly when it’s the first year of a presidential cycle. The average return in such instances is 2.7% for the S&P 500, though Q3 tends to be a little more shaky, according to LPL Research. Near-term, the S&P 500 has returned an average of 2.5% per year during April over the last two decades, with positive returns in 80% of years, according to EquityClock.com. So it’s a bullish time of year. Hopefully, we are not eating crow in next month’s letter!

Turning overseas markets, the developed market index of stocks outside of the US returned 2.5%, while Emerging Markets dropped 0.7%.

What’s interesting about the Emerging Market index today is that it is concentrated in a few giant technologies & consumer stocks (Alibaba, Tencent, and Taiwan Semiconductor). Emerging markets in 2021 look a heck of a lot different than they did in the mid-2000s when energy and materials-related companies drove that index. It goes to show that financial markets are constantly in flux. “Times they are always a-changin!”

In general, the US markets performed better than our foreign counterparts thanks to a stronger US Dollar Index over the last few weeks. The US Dollar index was up 2.6% in March. Longer-term, however, the US Dollar has fallen notably from its 2020 peak during the COVID crash.

The US bond market has been an interesting story this year. The first quarter featured an interest rate rise from under 1% to 1.75%. When bond yield rise, bond prices drop. For fixed-income investors, a near-term rise in rates harms returns. The US aggregate bond index fell 1.2% last month and was down more than 3% for the quarter (including dividends).

It is important to take a step back, though – higher interest rates will improve forward returns of bonds as new fixed income securities with higher interest rates are added to the index and lower-yielding assets mature. Still, with 5-year inflation expectation hovering near 2.6%, many bonds could have negative returns after inflation.

Vaccines and the consumer

“USA! USA! We are number 1!”

The US continues to progress nicely concerning COVID-19 vaccinations. The combination of an increasing number of Americans being fully vaccinated and huge stimulus checks hitting our collective coffers resulted in a jump in consumer spending – particularly from the old folks who are suddenly flying the friendly skies like they are teenagers taking a gap year.

Bank of America recently performed a survey in which their analysts asked respondents about spending plans. The results were broken out based on vaccination expectations.

Figure 5[iii] posed the question, “In the next 3 months, how much money do you expect to spend on ___ (% of “more than I do now” + “about the same as I do now” responses, combined)”

Figure 5: Three-month spending expectations based on vaccine administration (sorted by largest difference between fully vaccinated & not vaccinated respondents) – March

In general, those further along in the vaccination process appear more likely to spend a lot of money in the coming months. It’s yet another sign that all of us are just itching to get out and about again (even if it’s just to the grocery store!)

Conclusion

March was a good one for equity investors. It’s been an incredible run over the last year following those tumultuous times of March 2020. We must be mindful of risk in the market, and that is why we are prudent to rebalance portfolios and ensure your risk tolerance aligns with your portfolio. We all look forward to warmer weather and hopefully a return to some normalcy soon. Thank you for our relationship, and be safe!

[i] https://www.newyorkfed.org/medialibrary/media/survey/empire/empire2021/esms_2021_03.pdf?la=en

[ii] https://www.bloomberg.com/news/articles/2021-03-31/what-s-in-biden-s-2-25-trillion-infrastructure-and-tax-proposal?sref=vuYGislZ

[iii] Source: Survey Monkey, BofA Global Research Respondents: Not Vaccinated: 639 / Scheduled but not Vaccinated: 122 / Partially Vaccinated: 114 / Fully Vaccinated: 125