Every business owner faces a unique set of risks and opportunities, and the ability to manage them effectively can determine the success or failure of their enterprise. Taking too many risks can result in financial losses, damage to the reputation of the business, and even its closure. On the other hand, not taking advantage of opportunities can lead to missed growth potential, decreased market share, and loss of competitive advantage.

We understand that it’s not always easy to strike the right balance, but one way to help protect your business is by making sure your business has the right insurance coverage to help mitigate potential risks. Insurance can provide protection against unforeseen events that could cause financial losses, such as property damage, theft, liability claims, and natural disasters. Insurance allows business owners to transfer some of the risks they face to an insurance company, which can help mitigate the impact of these risks and provide financial support in case of a covered event.

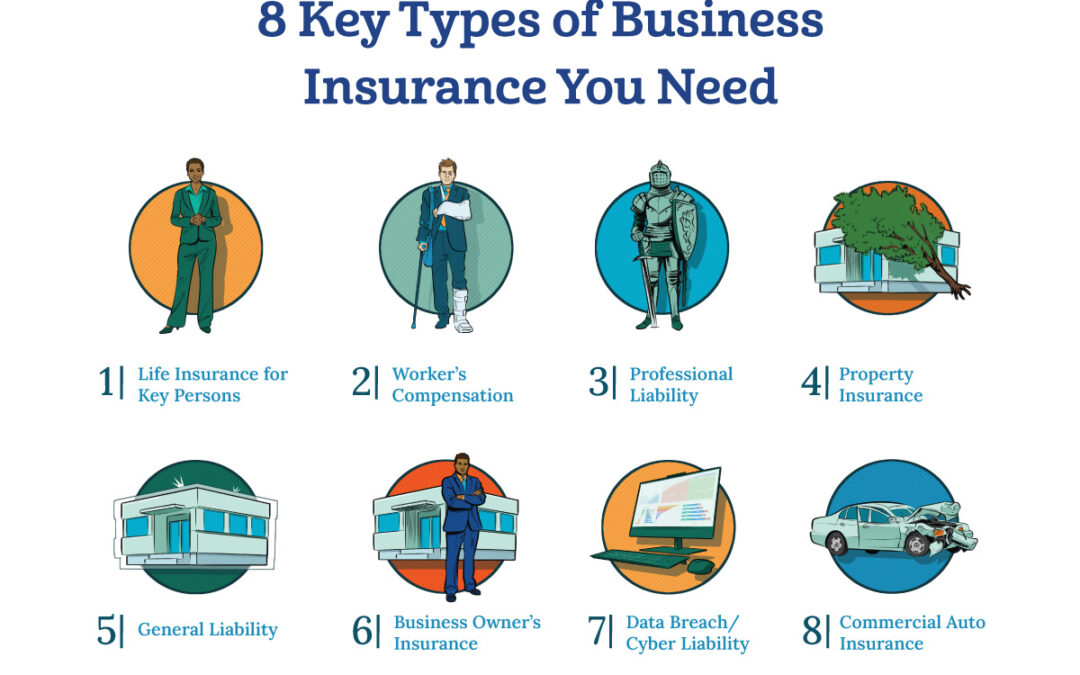

In this blog we break down the eight key types of insurance you should have to protect your business.

1) Life Insurance for Key Persons

1) Life Insurance for Key Persons

Key person life insurance is common for businesses to have one or a few key employees whose contributions are vital to the success of the company. If something were to happen to those individuals unexpectedly, it could have a devastating impact on your business. That’s where key person insurance comes in – it helps protect your company from the loss of critical employees and gives you the resources you need to regroup and move forward.

For example, let’s say you have a top salesperson who’s responsible for bringing in the majority of your company’s revenue. If something were to happen to them and they were no longer able to work, it could be a significant financial setback for your business. But with key person insurance, you can have peace of mind knowing that your company is protected.

Here are our top three reasons why a business would want insurance for key persons:

- Loss of Revenue: The sudden death or disability of a key employee can result in significant financial losses for a business, especially if that employee generates a significant portion of the company’s revenue. Key person insurance can provide financial support to help the business maintain its operations during this difficult time, cover any recruitment or training costs for a replacement employee, and compensate for any lost revenue.

- Business Continuity: In some cases, a key employee may have specialized knowledge or expertise that is critical to the business’s operations. If that employee is no longer able to work due to death or disability, the business may struggle to find a suitable replacement or maintain its operations. Key person insurance can provide a financial cushion to help the business stay afloat during this time, while it searches for a replacement or reorganizes its operations.

- Keep in mind: If the Key person is the majority owner, life insurance may be needed to facilitate the transition. Alternatively, the business can pay the surviving spouse/beneficiary out of cash flow, but as soon as the valuation is north of a couple of million, this approach can significantly impede business growth.

- Loans and Credit: Many businesses rely on loans or credit to finance their operations, and lenders often require a key person insurance policy to protect their investment in case of the death or disability of an essential employee. Key person insurance can provide the necessary funds to repay loans or credit, which can help the business avoid defaulting on its financial obligations and maintain its creditworthiness.

2) Worker’s Compensation

2) Worker’s Compensation

One of the best ways to take care of your employees is by providing workers’ compensation insurance. This insurance can help support employees injured on the job by providing them with replacement income and covering their medical expenses. In exchange for these benefits, employees give up the right to sue their employer over their work-related injury, regardless of who was at fault.

Please keep in mind that in all states except for Texas, businesses are required to have workers’ compensation insurance. If this insurance isn’t kept up-to-date, there may be significant penalties depending on the state. In the state of Michigan, an employer who fails to comply with the provisions of section 611 is guilty of a misdemeanor and may be fined not more than $1,000.00, or imprisoned for not more than 6 months, or both. Each day’s failure is a separate offense.

By having workers’ compensation insurance, you can help ensure that your employees receive the proper medical care and compensation they need in the event of a workplace injury. It also offers legal protection for business owners, which can be incredibly important in today’s world.

3) Professional Liability

3) Professional Liability

If your business involves providing services or advice directly to customers, it’s important to have professional liability insurance, also known as errors and omissions (E&O) insurance. This type of insurance can help protect your business from claims of negligence, failure to perform, or improper services.

For example, a financial planner might be accused of giving advice that results in significant financial losses for a client. Or a web developer could create code that fails to handle high traffic, causing the business to lose out on potential sales.

Having E&O or professional liability insurance can help cover the costs associated with these kinds of allegations. It can provide peace of mind and help ensure that your business is protected in case of any errors or negligence.

Keep in mind: Specialized professions could have additional insurance (eg Medical Malpractice for physicians). Med Malpractice provides coverage for losses related to the human body. Professional liability provides coverage for financial losses.

4) Property Insurance

4) Property Insurance

As a business owner, you know how important it is to protect your physical structures and assets from damage. That’s where business property insurance comes in – it can cover the cost to repair or rebuild your company’s structures in case of unexpected events such as fire, hail, theft, wind, smoke, or vandalism.

It’s important to note that business property insurance generally covers buildings, not other types of property like vehicles. If you have a commercial fleet, you’ll need to look into a commercial vehicle policy for coverage.

In some cases, property insurance can include a “business interruption” add-on. This can reimburse you for lost income related to property damage. For example, if your auto repair shop is damaged in a fire and only half of your bays are operational, property insurance with a business interruption rider would pay to repair your building and reimburse you for income lost while you operate at half your normal capacity.

Having the right business property insurance with adequate coverage levels can help protect your operations from unexpected events. And additional business interruption coverage can ensure that your earnings are protected if you have to temporarily shut down or operate below your usual capacity after an incident such as a fire or natural disaster.

5) General Liability

5) General Liability

As a business owner, you want to do everything you can to protect your company, and that’s where general liability insurance comes in. This type of insurance can help protect your business if someone experiences bodily injury, property damage, or other types of injury as a result of your operations.

For example, if someone slips and falls in your store or if you accidentally damage a customer’s property while working on their premises, repairs and medical bills can be costly. General liability insurance can cover legal costs and settlement payments or judgments that are awarded to the injured party.

It’s important to note that what general liability insurance covers can vary greatly from state to state, and the amount that the insurer will pay depends on the scope of coverage and the maximum amount stated in the policy. Since lawsuits can often be more expensive than the cap in a general insurance policy, many business owners choose to take out additional umbrella policies to cover additional costs.

6) Business Owner’s Insurance

6) Business Owner’s Insurance

A business owner’s policy (BOP) combines the most common types of property insurance and general liability insurance into one comprehensive package at a competitive rate. This means that you can get the coverage you need to protect your business from a wide variety of damage, such as customer falls or property damage, all in one place.

BOP insurance is generally purchased by small businesses, as it can provide great value for the coverage provided as they are very customizable and can be lumped together with broadening endorsements. For mid-market and larger businesses with more complex insurance needs, separate policies for each type of insurance may be necessary.

7) Data Breach/Cyber Liability

7) Data Breach/Cyber Liability

Data breach or cyber liability insurance can be a lifesaver for your business in the event of a cyber attack or hack. Personally identifiable customer information is at risk, including credit card numbers, Social Security numbers, addresses, medical details, phone numbers, birthdays, and even the names of family members. It’s a scary thought, but preparation is the enemy of fear!

Here’s how data breach/cyber breach liability insurance can help you: If your business stores any personal information about a customer, you’re definitely going to want to consider data/cyber breach liability insurance. In the case of a cyber security emergency, this insurance can give you the funds you need to react quickly and restore customer confidence and prevent further damage.

Data breach coverage includes:

- The cost of notifying affected parties of a data breach, as well as the cost of forensic analysis and credit monitoring services

- Breach restoration costs, which can include the cost of labor to recreate or copy lost or stolen data

- Cyber business interruption costs, which can cover extra expenses that result from a cyber breach.

Cyber liability coverage includes:

- Privacy and security liability for third-party claims arising out of a privacy breach or security breach, including loss or theft of private personal data or failure of your client’s system

- Cyber media liability addresses third-party claims arising out of an electronic media breach such as infringement, trademark, plagiarism, invasion of privacy, defamation, libel and slander resulting from cyber content

Some insurance companies even offer consulting services to help you put software and systems in place to avoid cyber in the first place.

8) Commercial Auto Insurance

8) Commercial Auto Insurance

If your business owns vehicles, commercial auto insurance has got your back. This type of insurance can help cover the costs of repairs, legal fees, and medical bills if you or one of your employees gets into an accident while driving for work. That way, you can focus on getting back on the road and running your business instead of worrying about the costs of an accident.

While there are differences from plan to plan, generally commercial auto insurance covers:

- First up is liability coverage, which can help cover bodily injury or property damage claims that you may be required to pay.

- Next, personal injury and medical payments coverage can assist in paying for appropriate and essential medical and funeral costs for those covered.

- If you’re in a collision with another object, collision coverage can help pay for damage to your vehicle, less the deductible.

- Comprehensive coverage can help cover the loss or damage of your insured vehicle, as long as it wasn’t caused by a collision or rollover, less any deductible.

- Finally, uninsured/underinsured motorist coverage can help pay for injuries and sometimes property damage if you’re in an accident with a person who doesn’t have enough liability insurance or is uninsured.

But what if you get in an accident in a personal car, when driving for work purposes? Enter Hired and Non-Owned Auto Insurance (HNOA). This type of insurance includes two different types of coverage:

- Hired coverage refers to the protection that your business has when you or your employees use a car that’s rented, leased, or borrowed for business purposes

- Non-owned auto coverage is for when employees use their own cars for business purposes. This type of coverage provides extra protection beyond the scope of the employee’s personal auto insurance, including liability for property damage and bodily injury.

So remember, it’s important to get hired and non-owned auto coverage if your business borrows or rents vehicles to do work or if your employees use their own cars for business purposes.

Set Your Business Up for Success

As a small business owner, it’s important to learn from the mistakes of others to avoid making them yourself. That’s why I highly encourage you to tune in to Traversing Entrepreneurship Podcast episode #22, where the topic of discussion is “Why Businesses Fail.”

In this episode, we delve deep into the common reasons why small businesses often fail and offer valuable insights on how to avoid them. From lack of market research to poor financial management, the episode covers the critical mistakes that many entrepreneurs make and how you can avoid them.

=> Click here to Listen <=