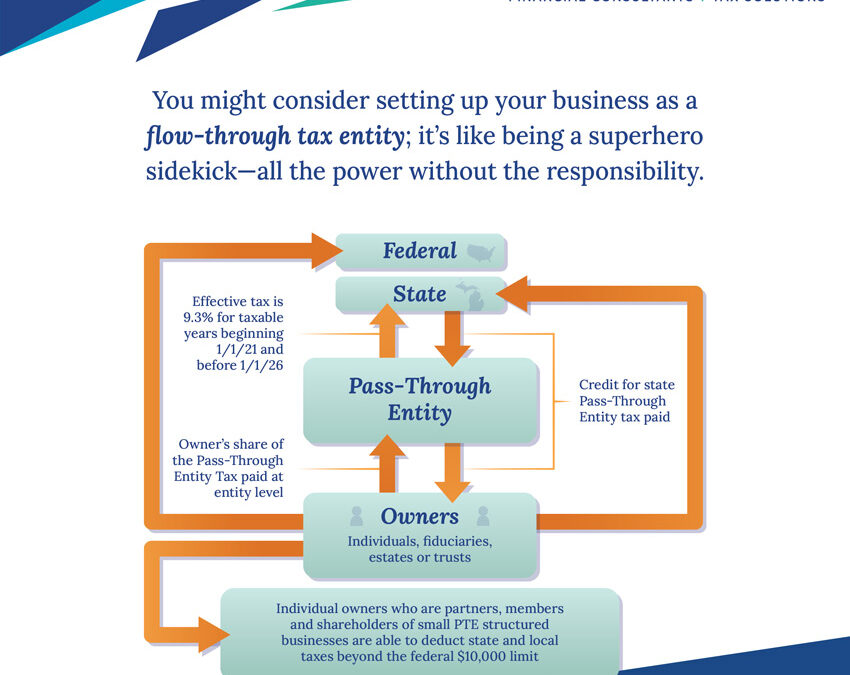

In 2021 Michigan enacted a tax known as a Flow-Through Entity tax (FTE), which is retroactive to tax years beginning on and after January 1, 2021. The continued levy of the tax is contingent upon the existence of the federal state and local tax (SALT) deduction limitation codified within IRC 164(b)(6)(B).

Under this law, eligible flow-through entities, including S Corporations and partnerships, can choose to file and pay taxes on the income belonging to owners at the entity level, rather than the owners’ individual tax returns. This new tax law allows owners to take advantage of the deduction on their state and local taxes while remaining in compliance with federal tax law.

This law helps flow-through entities get around the $10,000 SALT deduction limit, allowing them to take advantage of state and local tax benefits. The flow-through entity tax only applies to entities that meet the eligibility criteria, which includes being classified as a partnership or S Corporation for federal tax purposes. It does not apply to publicly traded partnerships, disregarded entities, or financial institutions subject to Corporate Income Tax.

Let’s dive in and better understand what the new flow-through entity tax means for Michigan business owners.

What The Heck is a Flow-Through Tax Entity?

A flow-through tax entity is a type of business structure in which the income or losses of the entity “flow-through” to the individual owners or shareholders, who then report that income or loss on their personal tax returns and are taxed accordingly based on their individual tax rates. This is in contrast to a traditional corporation, in which the business itself is taxed on its income and the shareholders are only taxed on any dividends they receive from the corporation.

If that sounds complicated and nuanced, that’s because it is. To better understand how the new tax impacts Michigan business owners, let’s dive in further…

How The Michigan Flow-Through Entity Tax Impacts Local Business Owners and Eligibility Explained

Eligible entities classified as partnerships or S Corporations for federal income tax purposes can opt to pay the new entity tax by making a three-year election. However, publicly traded partnerships, insurance companies, disregarded entities, and financial institutions are not eligible to do so.

Under the flow-through entity tax, eligible entities can pay taxes based on the income of owners who are individuals, trusts, estates, and eligible flow-through entities. Beneficiaries must report their portion of the tax for estates and trusts. If an entity has non-eligible owners, such as a corporate member, it may choose to file and pay taxes solely on the tax base related to its eligible owners.

Don’t forget! It’s still necessary for corporate members to report flow-through entity income in accordance with Part II of the Michigan Income Tax Act.

Key Benefits of Michigan’s Flow-Through Entity Tax:

- State and Local Tax Benefits: The flow-through entity tax provides a solution for owners of eligible entities to receive benefits from state and local tax deductions by allowing them to pay taxes on the income at the entity level.

- Increased Flexibility: Owners can choose whether to file taxes on their individual tax return or at the entity level, providing increased flexibility for tax planning.

- Federal Tax Law Compliance: The flow-through entity tax helps owners comply with federal tax laws while maximizing their tax benefits.

Key points to note regarding Michigan’s Flow-Through Entity Tax:

- Eligibility Criteria: To qualify for the flow-through entity tax, an entity must be classified as a partnership or S Corporation for federal tax purposes. Publicly traded partnerships, disregarded entities, and financial institutions subject to Corporate Income Tax are ineligible.

- Three-Year Election: Eligible entities must elect to pay and file taxes based on the income belonging to owners at the entity level, and the election is valid for three years. Entities can change their election each year.

- Reporting Requirements: Entities must report their portion of the flow-through entity tax to owners, including trusts and estates. If an entity has non-eligible owners, they can elect to file and pay taxes solely on the tax base relating to eligible owners. Corporate members should continue to report flow-through entity income under Part II of the Michigan Income Tax Act.

Take Action

Still confused about the recent changes in Michigan tax law? Derek and the team are here to guide you through the options for your business as you decide what will be best for your needs and unique situation. We know that as a business owner, you’re always looking for ways to reduce your tax burden and maximize profits. Let us help you weigh whether structuring your business as a a flow-through tax entity makes sense for your unique situation.