New rules may have left you confused. Do you know the current guidelines?

The IRS is getting $80 billion extra dollars—about six times their normal annual budget. What does this mean for small businesses? It possibly means that we all face closer scrutiny of our tax returns in the near future. Nobody wants an audit, and it’s now more important than ever to be clear on the rules and to document everything.

The rules for business meal and entertainment deductions changed, then changed again to help small businesses deal with the crisis of the last few years. The extra deductions for 2021 and 2022 have been great, but you may be understandably confused about what the rules for these deductions are now. What can safely be deducted in the eyes of the IRS? Let’s look at the current guidelines so you can avoid an audit.

The Rules Have Changed

To help the over 660,000 restaurants and their employees during COVID, Congress passed the Consolidated Appropriations Act in December 2022. This allowed businesses to deduct 100% of food and beverage purchases from restaurants in 2021 and 2022. This would be reflected on your 2023 tax returns.

But the rules have changed again. Now that the economy is getting back to normal and small businesses are getting back on their feet, the rules for meal and entertainment deductions have reverted to how they were defined in the Tax Cuts and Jobs Act of 2018.

Let’s break it down.

Meals

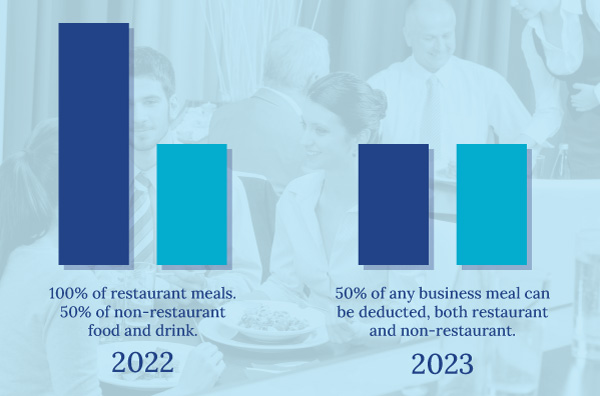

In 2021 and 2022, a business could deduct 100% of a meal if it was purchased from a restaurant and 50% of food and drink purchased from non-restaurants.

This is no longer true.

Now 50% of any business meal can be deducted. Here are the rules for claiming this 50% deduction:

- Your business meals must be an ordinary and necessary business expense, and they must not be subject to disallowance under tax code Section 274.3

- They can’t be lavish or extravagant. Don’t worry if the meals are expensive. According to the IRS, “Meal expenses won’t be disallowed merely because they are more than a fixed dollar amount or because the meals take place at deluxe restaurants, hotels, or resorts.”

- You must be present at the business meal to deduct it, and the person with whom you’re dining must reasonably be expected to have active engagement with your business.

Your business should be covered as long as you follow these three simple guidelines.

Entertainment

Entertainment for your clients or prospective clients can’t be deducted. Sorry, but you can’t deduct those basketball game tickets.

You can, however, deduct 100% of the entertainment provided primarily for your employees. According to the tax code, “expenses for recreational, social, or similar activities (including facilities) primarily for the benefit of employees” qualify for a 100 percent deduction. This could be a beach home or a ski cabin available for employee use; the maintenance of a baseball diamond, bowling alley, or golf course; or an employee holiday party or summer picnic.

The rule is that rank-and-file employees must have primary use over officers, shareholders, or other owners who own a 10 percent or greater interest in the business, or other highly compensated employees.

The practical application of this rule couldn’t be simpler. Let’s say your business has a lake house it wants to write off as an entertainment expense. The rule states that your rank-and-file employees must use the facility more days than the other groups. That’s it. So if the rank-and-file uses the lake house for 51 days and the other groups of employees use it for 49 days, you’re free to deduct 100% of the expenses.

By the way, this doesn’t mean that the facility is merely available for rank-and-file use more than the other groups, but that it must actually be used more. Something as simple as a guest book can be used to document use.

Examples

Let’s look at a few quick examples of these rules in real-life scenarios:

- You take a client out for dinner at a restaurant and pay for all food and drinks. This is a 50% deductible normal business meal expense.

- You take a client to a basketball game and pay for the tickets. While you’re at the game you also purchase a hot dog and a drink for each of you. You’ve got separate receipts for both the tickets and the food. The price of the tickets counts as entertainment and cannot be deducted. The food you bought at the game counts as a business meal and can be deducted at 50%.

- You take a client to a basketball game, but this time your tickets, food and drink are all part of a package deal. In other words, the food and drink aren’t separate items on the invoice. In this case, the ticket and food both count as entertainment expenses and cannot be deducted.

Documenting Your Expenses

When you’re documenting your deductible business expenses, be sure you keep both receipts and proof of payment. Your proof of payment alone wouldn’t necessarily include a list of the items you bought, so make sure you have a receipt, too. And since you need to have a documented reason for your deductions, include a note of these. For instance, if the company throws a holiday party for its employees, which is a 100% deductible entertainment expense, you could note that the party is an annual event to improve employee morale and loyalty. It’s as easy as that.

The Takeaways

- Business meals are 50% deducted as long as they are an ordinary and necessary expense with someone who may meaningfully engage with your business.

- Entertainment expenses are non-deductible unless they are for the primary benefit of your rank-and-file employees. Then they are 100% deductible

- Keep receipts showing exactly what was purchased, not just proof of payment (which may not show what was purchased).

- Your documents for entertainment expenses should include a note of the benefit to your employees.

- Following these simple guidelines from the IRS regarding business meals and entertainment expenses should help safeguard you from an audit at a time when the IRS may begin to monitor business expenses.