Health insurance: We all need it, but we hate to pay for it.

Why? You know why. It’s expensive, so deducting the price of premiums is important for you and your business.

As a pass-through entity, an S corporation’s income isn’t taxed at a corporate level, but is passed down to the individual shareholders who pay taxes on their share of the profits. This means that knowing the right way to deduct health insurance premiums will save both the corporation and every individual shareholder money—a lot of money.

Let’s get into the right way for an S corp and its employees to deduct health insurance costs.

The Difference Between Employees and Owners

Many people believe that any business type can offer tax free health insurance to both employees and owners and deduct the costs as a business expense.

This isn’t true.

An S corporation can do this for non-owner employees, but for owners it’s trickier. To add to the confusion, you may be considered an S corp owner and not even realize it! We’ll get back to that last point, but for now let’s look at the rules for deducting health insurance in an S corp.

The Rules

Imagine this scenario.

You own 100% of an S corporation. Your son works for it. He owns zero stock, but the corporation covers his health insurance with a group health policy.

How should his premiums be deducted?

You might think the cost of his premiums would be deducted as a business expense like any other employee’s. That’s wrong, because he’s a family member of a 100% owner, and as such his health insurance premiums are included as W-2 wages. Why is that?

Let’s look at the rules for owners.

The key number is 2%. If you own more than 2 percent of an S corporation, you need to follow three steps to deduct your health insurance premiums:

- Get those premium costs on the S corp’s books. Either the corporation pays the premiums for you (and your spouse or dependents, if applicable) or you pay the premiums and the corporation reimburses you.

- The S corp must include the premium costs on your W-2 as box 1 taxable income (but not boxes 3 and 5). This income is not subject to Social Security, Medicare (FICA) or Unemployment (FUTA) taxes.

- You claim the health insurance as an above-the-line deduction on Form 1040, assuming that you or your spouse is not eligible for employer-subsidized health insurance and the premiums don’t exceed your W-2 earned income from the S corp.

Again, these rules apply to any shareholder-employee who owns more than 2 percent of the S corporation.

How Does This Affect Owner’s Families?

To clarify: If your parents own 100 percent of an S corp and you work for that S corp, under Section 318 attribution rules you are considered a 100 percent owner, too. The S corp would include the cost of your health insurance on your W-2 as box 1 income and deduct it from their own tax return as a wage expense.

And this applies to any of the family members mentioned above who work for the S corp. This means a lot of people’s family members—maybe yours—aren’t eligible for normal employee tax free health insurance, but they’re still eligible for tax-advantaged premiums.

To make sure we’ve got all this straight, here’s one more example.

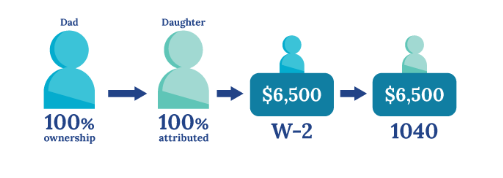

Imagine you own 100 percent of your S corporation business.

You employ your daughter as a manager in the business and pay her $75,000 per year. The company also provides her health insurance as part of your group plan. It costs the S corp $6,500 per year.

Code Section 318 attributes your S corporation stock ownership to your daughter. Since any direct family member, dependent or not, is “automatically” considered a 2% owner of the S corporation for health insurance deduction purposes, so the S corp must include the $6,500 as box 1 wages on her W-2 and deduct $6,500 on its tax return as a wage expense. Your daughter may also claim the $6,500 as a self-employed health insurance deduction on Schedule 1 of her Form 1040 (assuming she’s not eligible for other subsidized health insurance coverage).

And that’s how it works, but what if the S corp has already made a mistake?

Fixing Mistakes

Maybe the S corp didn’t know these rules and treated a person with attributed ownership as a non-owner employee. What can you do?

You can fix it. Here’s how:

How to Fix an Attribution Error

You need to do three things to correct an attribution failure:

- Amend the S corporation tax return to claim the insurance expense as a wage expense.

- Amend the family member’s W-2 to include the insurance amount as box 1 wages.

- Amend the family member’s Form 1040 to correct the W-2 wages and claim the self-employed health insurance deduction.

How to Fix a 1040

Amend the family member’s Form 1040 to claim the self-employed health insurance deduction. If the amended Form 1040 shows a refund, you have either three years from the filing date or two years from the date you paid the tax to amend and claim the refund.

Summary

- For an S corp, deducting health insurance is different for owner employees and non-owner employees.

- If an employee also owns more than 2% of the S corporation, they are not eligible for tax free health insurance premiums, but they’re still eligible for tax advantaged health premiums. The S corp can’t just offer them insurance and write it off as a business expense.

- Code Section 318 attributes the same amount of ownership to the family of the owner for health insurance purposes. If you own 100% of the S corp, your wife and children (and other extended family) are also counted as 100% owners.

- The cost of health insurance is included on the owner employee’s W-2 as box 1 wages and on the S corp’s tax return as a wage expense.

- If errors in filing have already been made within the past 2 or 3 years, you can amend those returns and claim the extra refund.